fha gift funds limit

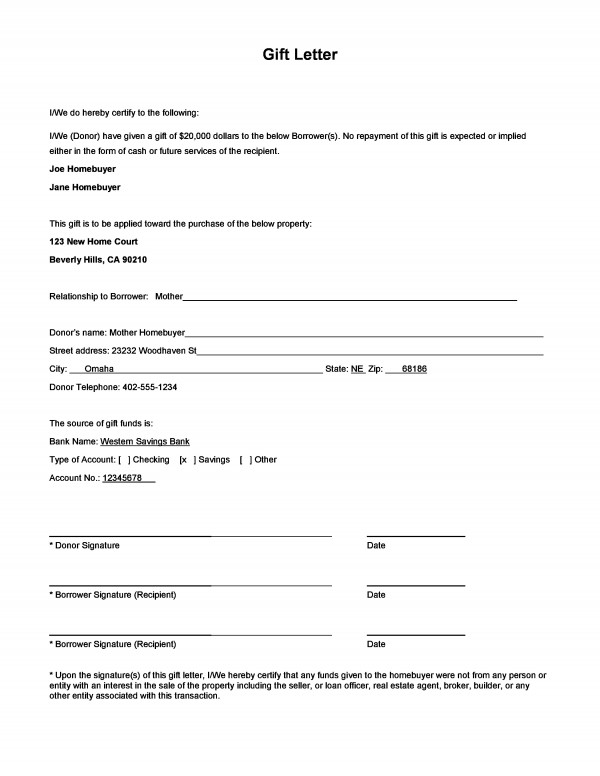

This could mean that buyers. Gift Funds In order for funds to be considered a gift there must be no expected or implied repayment of the funds to the donor by the borrower.

Gift Funds When Is A Gift A Gift According To Fha

The portion of the gift not used to.

. Here are some guidelines when using a gift fund for FHA. FHA gift funds are assets given from a donor to a borrower via cash or equity with no expectation of repayment. In our last blog post we answered a reader question about whether its acceptable to receive gift funds from a family member for an FHA borrowers down payment.

Gift Funds In order for funds to be considered a gift there must be no expected or implied repayment of the funds to the donor by the borrower. Use gift money to pay for the down payment and closing costs. Gift funds are commonly used for home loan expenses.

Borrowers with a credit score of 500 579 need a down payment of at least. This is much lower than a. If a gift will be used click Gifts or.

This could mean that buyers essentially can purchase a home with no cash. All of your down payment funds can be a gift if you put down 20 or more. The 203b and 203k only require a 35 percent down payment.

FHA Loans Gift Funds and Inducements to Purchase. Borrowers with a credit score of 580 or higher need 35 of the homes value as a down payment. Provide executed gift letter.

When a borrower applies for an FHA home loan a down payment is required for all transactions. At least 35 of your down payment needs to. Gift of equity 35 down payment.

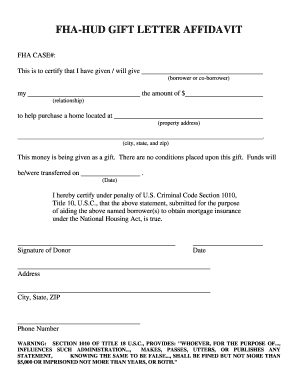

If you are applying for a FHA loan the FHA Certification section must be signed by both the gift donor and the recipient. 35 down payment Gift of equity. FHA loan rules in HUD 40001 have specific guidelines where gift funds to the borrower are concerned.

If the property usage falls under the FHA Secondary Residence policy and guidelines please a check mark in the FHA secondary residence SR field. FHA guidelines for gift funds. Gift Funds Already Received.

The FHA Federal Housing Administration is the easiest path to homeownership. How to Use Gift Funds for Your FHA Mortgage in 2022. January 26 2017.

When a family member sells you their house but gives you a discount on. GCA Mortgage Mortgage Experts With No Overlays. FHA loans requires that borrowers who receive a Gift of Equity must have a minimum down payment of 35 percent of the homes final purchase price.

The seller is allowed to pay up to 6 of the sales price toward. Essentially borrowers can use FHA gift funds toward a down. Loan amount for FHA.

The short answer is yes in 2019 the minimum required down payment for an FHA loan which is 35 can be gifted from a family member a friend an employer or some other approved.

Rules For Using Gift Funds As A Down Payment

Using Gift Funds To Buy A Home Homebridge Financial Services

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Gift Letter Affidavit Form Fill Out And Sign Printable Pdf Template Signnow

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

New Fha Loan Limits In 2020 New American Funding

The Perfect Holiday Gift Money For A Down Payment Pacres Mortgage

:max_bytes(150000):strip_icc()/fhaloan.asp-V1-773ce9699c13471b9bf8f53e7d3824d5.png)

Federal Housing Administration Fha Loan Requirements Limits How To Qualify

How To Use Gift Money For A Down Payment On A Home

Gift Money For Down Payment Free Gift Letter Template

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Gift Letter

Down Payment Gifts And How To Use Them

How Can An Fha Loan Help You Moreira Team Mortgage

How To Use Gift Letters For Your Mortgage Rocket Mortgage

Fha Loan Rules On Down Payment Assistance Gift Funds

Fha Home Loans Offer Lower Down Payments And Higher Limits To Tulsa And Eastern Oklahoma Buyers Fha

:max_bytes(150000):strip_icc()/rules-for-documenting-mortgage-down-payment-gifts-4157907-FINAL-9c59d5c0b3e445e1a142b323f35176e1.png)